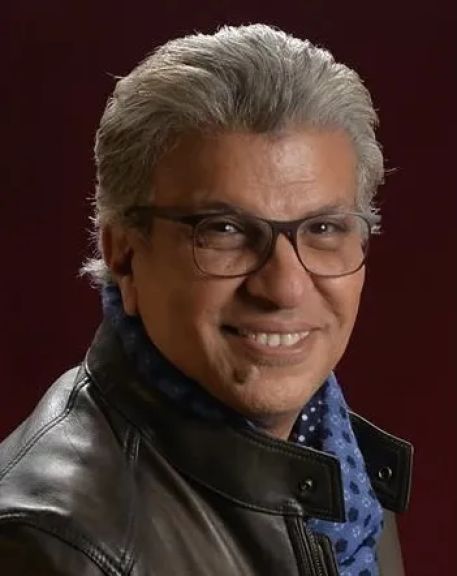

Garnett Genuis, MP writes: Prices Are Going Up

I am hearing growing concern about the record high prices of real estate and other goods. These are symptoms of the ramping up of inflation in our economy. In May, the annual rate of inflation was at its highest since 2008 at 3.6%, when in a typical year, the Bank of Canada aims for a rate of 2%.

Inflation is calculated by creating a sample of goods used by Canadians in their everyday lives and tracking the costs of those goods. When inflation increases it is a direct representation of how much more the average Canadian is paying to live.

Although there are other factors such as supply that are contributing to this rise in prices, an important influence is the pandemic monetary policy of printing of new Canadian dollars, typically known as quantitative easing. This policy utilizes newly printed money to buy government debt and financial assets so that money can be injected into the economy through government spending and the financial market.

In theory, the money from quantitative easing is locked away into financial assets which prevents the inflation we’ve seen in other countries when printed money flows straight into the money supply. Still, we are seeing higher than expected inflation and an increased cost of living for everyday Canadians.

Inflation reduces the value of money, and therefore reduces the value of your savings. Also, the money being printed goes into buying financial assets, increasing the wealth of those who own the assets. Through higher inflation, the wealthiest owners of assets become wealthier, while many everyday savers see the real value of what they own go down.

Everyday Canadians are hurt by inflation, and yet record-setting amounts of money have been printed to finance government debt. Good government involves taking responsibility for the situation and protecting the interests of all Canadians. The economic management of this government has been disappointing, and it is starting to take its toll on the pocketbooks of the middle class.

Garnett Genuis, MP

Sherwood Park – Fort Saskatchewan